Home Equity Loan Guide: How to Apply and Certify

Home Equity Loan Guide: How to Apply and Certify

Blog Article

The Top Reasons Property Owners Choose to Safeguard an Equity Finance

For numerous house owners, selecting to protect an equity finance is a critical financial choice that can offer numerous benefits. From combining financial debt to embarking on significant home remodellings, the factors driving individuals to choose for an equity funding are impactful and diverse (Equity Loans).

Financial Debt Debt Consolidation

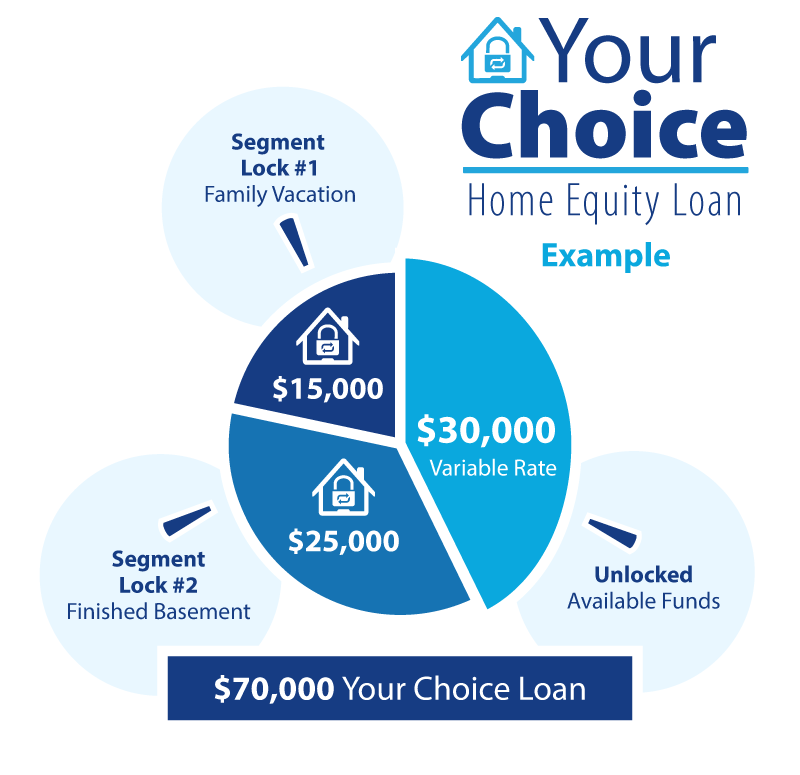

Home owners often go with protecting an equity funding as a strategic monetary step for financial debt loan consolidation. By leveraging the equity in their homes, people can access a round figure of cash at a reduced rates of interest compared to other forms of loaning. This funding can then be made use of to repay high-interest debts, such as credit card balances or personal loans, enabling homeowners to streamline their financial responsibilities right into a solitary, much more manageable monthly settlement.

Debt debt consolidation via an equity funding can provide several advantages to homeowners. The reduced rate of interest rate connected with equity fundings can result in substantial price financial savings over time.

Home Renovation Projects

Thinking about the enhanced worth and functionality that can be achieved through leveraging equity, numerous individuals decide to designate funds towards different home renovation jobs - Alpine Credits Canada. House owners typically choose to secure an equity financing specifically for remodeling their homes due to the significant rois that such jobs can bring. Whether it's updating obsolete features, expanding home, or enhancing power efficiency, home improvements can not just make living spaces a lot more comfy but also enhance the overall worth of the property

Usual home improvement tasks funded via equity car loans consist of cooking area remodels, shower room remodellings, cellar completing, and landscaping upgrades. By leveraging equity for home enhancement jobs, house owners can create areas that better match their needs and preferences while also making an audio financial investment in their home.

Emergency Situation Expenditures

In unforeseen scenarios where instant monetary assistance is called for, securing an equity lending can supply house owners with a sensible solution for covering emergency expenditures. When unexpected events such as clinical emergency situations, immediate home repairs, or sudden job loss arise, having accessibility to funds via an equity loan can offer a safeguard for house owners. Unlike other kinds of borrowing, equity car loans normally have lower interest prices and longer repayment terms, making them a cost-efficient choice for addressing instant economic needs.

Among the key benefits of utilizing an equity finance for emergency expenditures is the rate at which funds can be accessed - Alpine Credits Canada. Home owners can promptly use the equity built up in their property, enabling them to deal with pressing economic issues immediately. Furthermore, the versatility of equity financings makes it possible for home owners to borrow only what they need, staying clear of the worry of tackling extreme financial debt

Education And Learning Financing

In the middle of the pursuit of higher education, securing an equity financing can function as a critical financial source for home owners. Education and learning financing is a considerable issue for many households, and leveraging the equity in their homes can supply a means to gain access to required funds. Equity lendings commonly supply lower rate of interest compared to various other kinds of borrowing, making them an attractive alternative for funding education and learning expenses.

By tapping into the equity developed in their homes, house owners can access substantial quantities of cash to cover tuition fees, publications, lodging, and other relevant costs. Home Equity Loan. This can be specifically useful for parents aiming to support their youngsters via college or people looking for to advance their own education. Furthermore, the passion paid on equity car loans might be tax-deductible, providing prospective monetary benefits for borrowers

Inevitably, utilizing an equity lending for education and learning funding can assist individuals purchase their future earning possibility and career improvement while properly managing their financial obligations.

Investment Opportunities

Conclusion

In conclusion, house owners select to protect an equity funding for various factors such as debt loan consolidation, home renovation tasks, emergency expenditures, education and learning funding, and investment opportunities. These fundings supply a way for homeowners to gain access to funds for vital economic needs and goals. By leveraging the equity in their homes, property Check Out Your URL owners can take benefit of reduced rates of interest and versatile repayment terms to attain their economic goals.

:max_bytes(150000):strip_icc()/home_equity.asp-final-59af37ca6ebe48f3a1e0fd6e4baf27e4.png)

Report this page